Tracing Debtors in the UK

Tracing Debtors in the UK

Tracing debtors in the UK presents unique challenges, particularly when individuals are actively avoiding detection. Unlike locating other individuals, tracing debtors requires specialised strategies and tools, as these individuals may employ various tactics to remain undetected.

In the financial landscape of the UK, debt recovery is an essential yet often challenging aspect of maintaining healthy cash flow for businesses and individuals alike. When debts go unpaid, creditors are faced with the daunting task of locating debtors who may have gone to great lengths to disappear from view. Tracing these debtors is not as straightforward as finding a person who has merely moved house or changed jobs; it involves navigating a minefield of deliberate evasive tactics and sophisticated means of concealment.

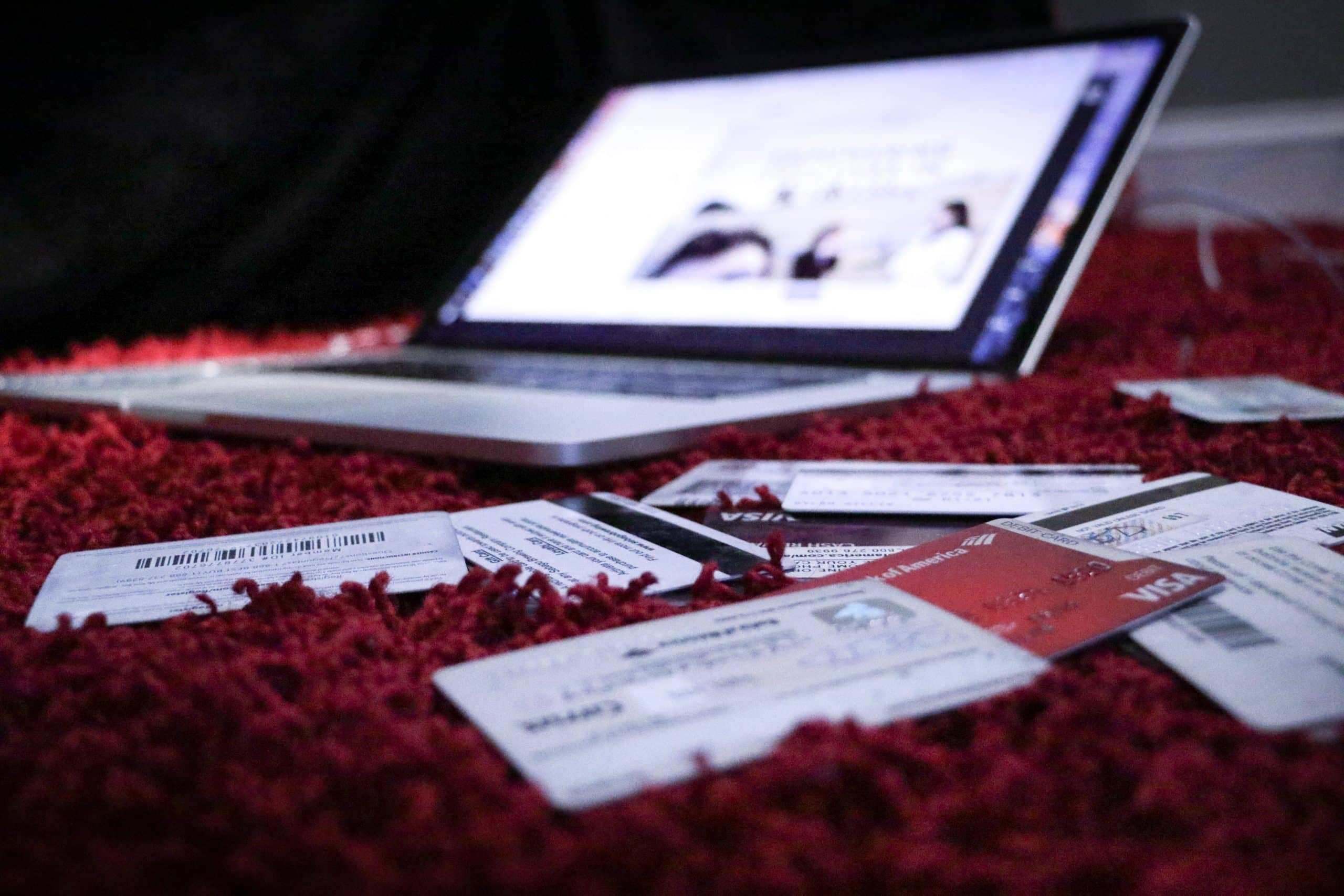

Unlike the search for an old friend or a long-lost relative, where the individual may wish to be found, debtors often actively avoid detection. This makes the process of tracing them inherently more complicated and requires a different set of skills, tools, and strategies. The act of debtor tracing is not just about following a paper trail—it’s about outmaneuvering individuals who may have every intention of staying hidden. These individuals might employ various methods to remain undetected, such as changing their names, using false identities, relocating frequently, or even operating under the radar by using the identities of partners or family members to avoid leaving a traceable footprint.

For creditors, the inability to locate a debtor can lead to significant financial loss. Whether it’s a business seeking to recover unpaid invoices or an individual looking to reclaim personal loans, the stakes are high. The process of debt recovery is not only about recuperating lost funds but also about maintaining the integrity and sustainability of the creditor’s financial operations. Therefore, effective debtor tracing becomes a critical component of the debt recovery process, ensuring that creditors can enforce their rights and secure the repayments they are owed.

However, the complexities involved in tracing debtors in the UK necessitate the use of specialized techniques and resources. This is where the expertise of professional debtor tracing agents or private investigators becomes invaluable. These professionals have the experience and access to advanced tools that allow them to navigate the often convoluted paths that debtors may take to avoid detection. From sophisticated data analytics to deep dives into credit histories and the use of legal resources, tracing agents are equipped to handle the various challenges that come with locating a debtor.

This article aims to unravel the intricacies of debtor tracing in the UK, shedding light on the unique obstacles faced by creditors and providing practical advice on how to effectively locate and recover debts. By understanding the methods used by tracing agents and the strategies that can be employed, creditors can better prepare themselves for the challenges of debt recovery and increase their chances of success in reclaiming what is rightfully theirs. Whether you are a business owner, a legal professional, or an individual seeking to recover a personal debt, the insights provided here will equip you with the knowledge needed to navigate the often complex and challenging world of debtor tracing in the UK.

Trace Your Debtors Now! 🚀

Don’t let debtors disappear. With expert debtor tracing, you can track them down and recover what’s owed to you. Get started with Find UK People®—quick, reliable, and no-find no-fee.

Ready to take action? Start Tracing Today!

- Do you need to locate a company directors home address? This service can locate a company directors home address in just 24 hours!

The Importance of Using a Debtor Tracing Agent

In the increasingly complex world of debt recovery, the role of a specialist debtor tracing agent cannot be overstated. As economic pressures mount and the number of people in debt continues to rise, creditors face a growing challenge in recovering outstanding amounts. Debtor tracing has evolved into a sophisticated field that requires more than just basic investigative skills; it demands a deep understanding of the tactics debtors might use to avoid detection, as well as access to advanced tools and databases that are often beyond the reach of the average individual or business.

Engaging a specialist tracing agency, such as Find UK People®, is a crucial step in the debt recovery process. These agencies bring a wealth of experience and expertise to the table, having honed their skills in locating individuals who are actively trying to remain hidden. Unlike general investigators or non-specialized agencies, a specialist debtor tracing agent is equipped with a nuanced understanding of the debtor’s mindset, the specific strategies they might employ to avoid being found, and the most effective methods to counter these strategies.

One of the primary reasons to use a specialist is their access to sophisticated and often proprietary tools that allow for a thorough and accurate search. These tools include advanced data analytics, real-time access to credit reference agency data, and the ability to cross-reference information from multiple sources. For instance, while a typical person might rely on basic online searches or public records, a specialist tracing agent can delve into detailed credit address links, electoral roll data, and even obscure financial records that can provide critical leads on a debtor’s whereabouts.

Moreover, the experience of specialist tracing agents is indispensable when dealing with the myriad ways in which debtors may attempt to cover their tracks. Debtors may frequently change addresses, use aliases, or even assume new identities to evade their obligations. They might also use legal loopholes or exploit privacy laws to make it more difficult for creditors to locate them. A specialist tracing agent not only understands these tactics but is also well-versed in the legal frameworks surrounding privacy and data protection, ensuring that all tracing activities are compliant with the law while still being effective.

The current economic climate has seen a significant increase in the number of individuals struggling with debt, which in turn has led to a surge in the demand for debt collection services. With this increase, the importance of accurate and efficient debtor tracing has never been more critical. Before any debt recovery action can commence, it is vital to confirm the debtor’s current address. This is not just a procedural step; it is a legal requirement. Sending legal communications, such as letters before action or court summonses, to the wrong address can have severe consequences. It can result in delays, increased costs, and in some cases, the invalidation of the entire debt recovery process.

Ensuring that communications reach the correct address is also essential for upholding the principles of fairness and justice. The legal system requires that debtors are given the opportunity to respond to claims against them. If a debtor is unaware of the proceedings due to incorrect contact details, they cannot exercise their right to defend themselves, which can lead to judgments being made in their absence. This not only undermines the integrity of the legal process but can also lead to further complications for the creditor, such as having to restart the process or facing legal challenges from the debtor at a later stage.

Specialist debtor tracing agents like Find UK People® understand the gravity of these issues and employ meticulous methods to verify and confirm a debtor’s current address. Their approach is comprehensive, often involving multiple verification steps to ensure that the information they provide is accurate and up-to-date. This might include cross-referencing data from various sources, conducting on-the-ground investigations, and utilizing the latest in data technology to track even the most elusive of debtors.

In summary, the importance of using a specialist debtor tracing agent lies in their ability to navigate the complexities of debtor tracing with precision and efficiency. They offer a level of expertise and access to resources that can significantly improve the chances of successfully locating a debtor and recovering outstanding debts. For creditors, whether individuals or businesses, the investment in a specialist tracing service is not just about finding a debtor; it’s about ensuring that the entire debt recovery process is legally sound, efficient, and ultimately successful.

Common Evasion Strategies Used by Debtors

Debtors often employ various tactics to avoid being traced, including:

– Going Off-Grid: Debtors may put all financial applications in a partner’s name to avoid detection. Specialist tracing agents can navigate around this by using advanced tracing software and live data sets to identify the correct address.

– Denial at the Door: Debtors may deny their identity when approached at their residence. Experienced agents can counter this by checking recent credit applications, telephone billing records, and other data points to confirm residency.

Credit Agency Data uses in Debtor Tracing

Credit Reference Agency (CRA) data plays an indispensable role in the field of debtor tracing, serving as one of the most reliable and powerful tools available to tracing agents. This data is not only vital for establishing a debtor’s current whereabouts but also for constructing a comprehensive picture of their financial history and behaviour.

Specialist tracing agencies, such as Find UK People®, leverage CRA data to identify connections between a debtor’s past and present, enabling them to track down individuals who may have otherwise slipped through the cracks.

Understanding Credit Reference Agency Data

Credit Reference Agencies in the UK, such as Experian, Equifax, and TransUnion, maintain extensive databases that collect and aggregate information on individuals’ credit activities. This data includes a wide range of details, such as credit applications, outstanding loans, payment histories, and any associations with other addresses. When a debtor applies for credit, whether it’s a credit card, loan, mortgage, or even a mobile phone contract, their application typically includes their current address. This creates a link between the debtor’s identity and their location, which is then recorded and updated within the CRA’s database.

For tracing purposes, CRA data is invaluable because it provides a historical trail of addresses associated with a debtor. This trail can reveal movements over time, showing how a debtor’s residence has changed as they may have moved from one location to another. By analysing these address links, a tracing agent can map out the debtor’s likely current address, even if the debtor has not voluntarily provided their new details to the creditor.

How Tracing Agents Utilise CRA Data

Specialist tracing agents have the expertise and the legal authority to access CRA data, allowing them to tap into a wealth of information that is not publicly available. When a creditor engages a tracing agent to locate a debtor, one of the first steps is often to conduct a search using CRA data. This process involves looking for any recent credit activity that might indicate a change of address. For example, if a debtor has recently taken out a new loan or opened a bank account, the address provided during that application will be linked to their credit file.

However, simply identifying a potential address is not enough. The accuracy of this information is paramount, as sending legal notices to the wrong address can have significant legal and financial repercussions. To ensure the reliability of the address, tracing agents typically cross-reference the CRA data with other non-credit sources. This might include checking telecommunications records, such as active phone lines registered at the address, or utility bills that confirm the debtor is indeed residing at that location. By doing so, the tracing agent can provide a high level of confidence that the debtor is at the address identified through the CRA data.

The Advantages of Using CRA Data

The use of CRA data in debtor tracing offers several key advantages:

1. Comprehensive Historical Data: CRA data provides a detailed history of a debtor’s credit activities and address changes, offering tracing agents a robust starting point for locating individuals who may have moved multiple times.

2. Current and Up-to-Date Information: Because CRA data is continually updated with every new credit application or financial transaction, it often provides the most current address information available, making it a crucial tool for quickly finding debtors.

3. Linking Multiple Data Points: CRA data allows tracing agents to link various data points, such as previous addresses, financial activity, and known associates. This helps in building a complete profile of the debtor, which can be crucial in cases where the debtor has taken steps to obscure their location.

4. Legally Accessible: While private individuals do not have direct access to CRA data, specialist tracing agents are licensed and authorised to use this information, ensuring that the tracing process is conducted legally and ethically.

Verifying CRA Data with Additional Sources

While CRA data is an essential tool, it is not infallible. There are instances where a debtor may provide false information on a credit application, or where multiple individuals might be linked to the same address, creating potential confusion. To mitigate these risks, tracing agents verify CRA data by cross-referencing it with additional sources.

Telecommunications records are particularly useful in this regard. For instance, an agent might check if a phone line registered to the debtor is active at the suspected new address. Utility records, electoral rolls, and even social media profiles can also provide corroborating evidence that the debtor resides at the address identified through CRA data.

In some cases, tracing agents might also use field agents to conduct physical verifications, especially in high-value cases where the accuracy of the address is of utmost importance. This multi-layered verification process ensures that the final address provided to the creditor is as accurate as possible, reducing the likelihood of costly mistakes in the debt recovery process.

The Role of CRA Data in Tracing Compliance

Another critical aspect of using CRA data is ensuring compliance with legal requirements. In the UK, creditors are obligated to send legal communications, such as court summonses or letters before action, to the debtor’s current address. Failure to do so can result in the dismissal of the case or even legal repercussions for the creditor. By using CRA data to confirm an address, tracing agents help creditors meet these legal obligations, ensuring that all communications are sent to the correct location and that the debtor is given a fair opportunity to respond.

In conclusion, the role of Credit Reference Agency data in debtor tracing is multifaceted and indispensable. It not only provides a detailed and current view of a debtor’s whereabouts but also serves as a foundation upon which tracing agents can build a comprehensive search strategy. By combining CRA data with other verification methods, specialist tracing agents ensure that creditors have the accurate, reliable information they need to proceed with confidence in their debt recovery efforts.

Information Needed for Effective Debtor Tracing

The success of debtor tracing heavily depends on the quality of the information provided. Essential details that can aid in locating a debtor include:

– Full names, including middle names

– Date of birth

– Partner’s name

– Last known and previous addresses

– Telephone numbers, even if disconnected

– Mobile numbers and email addresses

– Employment details

– Business or personal websites

Even if some information is missing, a skilled tracing agent can still successfully locate the debtor.

Understanding a Debtor’s Financial Status

Locating a debtor is just one part of the debt recovery equation; equally important is understanding the debtor’s financial status. This insight is critical because it provides a clear picture of the debtor’s ability to repay the outstanding debt and informs the most effective strategy for pursuing recovery.

Without this crucial information, creditors risk spending time and resources on legal actions that may ultimately yield little to no return.

Assessing a Debtors Financial Status

A debtor’s financial status encompasses both their assets and liabilities. Assets might include properties, vehicles, bank accounts, or any other valuable holdings that could potentially be used to satisfy the debt. Liabilities, on the other hand, refer to the debtor’s existing obligations, such as mortgages, loans, or other debts that may reduce their ability to repay what they owe to you.

Understanding this financial landscape is essential for several reasons:

1. Informed Decision-Making: Knowing whether a debtor has significant assets or is heavily burdened by liabilities allows creditors to make informed decisions about whether to proceed with legal action. For example, if a debtor owns valuable property or has substantial savings, it may be worth pursuing immediate legal action to recover the debt. Conversely, if the debtor has few assets and is already overwhelmed by other debts, it might be more strategic to delay action until their financial situation improves.

2. Cost-Benefit Analysis: Pursuing a debt through the courts can be expensive and time-consuming. Court fees, legal representation, and enforcement actions all come at a cost. If a debtor has no significant assets or income, these costs could outweigh any potential recovery. By assessing the debtor’s financial status upfront, creditors can avoid the pitfall of throwing good money after bad, ensuring that any recovery efforts are economically viable.

3. Strategising Enforcement Actions: Different enforcement actions are suited to different financial situations. For instance, if a debtor owns property, a charging order might be an appropriate enforcement tool, which could eventually lead to a sale of the property to satisfy the debt. If the debtor is employed, an attachment of earnings order could be used to deduct repayments directly from their salary. Understanding the debtor’s financial status allows creditors to tailor their enforcement strategy to the specific circumstances of the case.

Tools for Assessing Financial Status

Specialist tracing agents often offer financial background checks as part of their services. These checks provide a detailed overview of a debtor’s financial standing, including information on assets like real estate holdings, vehicles, and business interests, as well as liabilities such as outstanding loans, mortgages, and other debts. The information gathered can include:

– Property Ownership: A search of the Land Registry can reveal whether the debtor owns any property in the UK, including details on the value of the property and whether it is mortgaged.

– Business Interests: If the debtor is a director or shareholder in a company, this can be identified through Companies House records, which may indicate whether they receive income from a business or have other financial interests.

– Bank Accounts and Savings: While not directly accessible, certain indicators, such as lifestyle spending, credit applications, and banking relationships, can give a sense of the debtor’s liquidity.

– Outstanding Debts and Credit Commitments: Credit reference data can highlight existing liabilities, including any County Court Judgments (CCJs) against the debtor, which could indicate financial distress or prioritize claims from other creditors.

These checks are crucial for painting a full picture of the debtor’s financial situation and are typically conducted before any legal action is initiated. This ensures that the creditor has all the necessary information to decide on the best course of action.

Strategic Considerations Based on Financial Status

Once a debtor’s financial status is understood, creditors can develop a strategic plan for recovery. Here are some key considerations:

1. Timing Legal Action: If the debtor’s financial status suggests that they are currently unable to repay the debt but have the potential to improve their financial situation (e.g., they are temporarily unemployed but have a history of high earnings), it may be wise to delay legal action. Creditors have up to six years from the date of the debt to initiate legal proceedings, and another six years after obtaining a judgment to enforce it. This allows flexibility in timing, so creditors can wait until the debtor is more likely to be able to pay.

2. Choosing the Right Enforcement Method: The financial status will also guide the choice of enforcement actions. For instance, if a debtor has a significant asset like a property, a creditor might pursue a charging order, which secures the debt against the property and can be enforced when the property is sold. If the debtor has regular employment, an attachment of earnings order might be more appropriate, ensuring that a portion of their salary is diverted to repay the debt.

3. Mitigating Risk: Understanding a debtor’s financial situation helps mitigate the risk of further loss. If a debtor is a “man of straw,” meaning they have no significant assets or income, pursuing aggressive legal action could result in wasted effort and additional costs. In such cases, it may be more prudent to seek a settlement or write off the debt, rather than incur further losses.

4. Negotiating Settlements: Sometimes, the most practical approach, particularly with debtors who have limited means, is to negotiate a settlement. Armed with knowledge of the debtor’s financial status, creditors can propose a realistic repayment plan or accept a lump sum that reflects the debtor’s ability to pay, thus recovering some of the debt without the need for costly litigation.

In the realm of debt recovery, understanding a debtor’s financial status is as important as locating them. It provides the necessary insight to make strategic decisions about whether to pursue legal action, how to enforce a judgment, and when it might be more prudent to wait or negotiate.

By assessing the financial landscape before taking action, creditors can avoid unnecessary expenses and increase their chances of successful debt recovery. Engaging a specialist tracing agent to conduct a thorough financial background check is a critical step in this process, ensuring that creditors have the information they need to act effectively and efficiently.

The Process of Tracing a Debtor

Once a debtor’s new address has been identified, the tracing agent will provide a detailed report outlining the sources of information used. This report typically includes credit agency data and may recommend further steps, such as employing a process server to deliver legal documents.

In high-value cases, verifying the debtor’s presence at the new address through a process server is strongly advised.

Is It Worth Chasing a Debt?

Before pursuing a debtor, it’s important to consider whether the effort and expense are justified. Factors to consider include:

– Prospects of Winning the Claim: The likelihood of success in court depends on the strength of your evidence, such as valid invoices and records of the transaction.

– Debt Collection Costs: Assess whether the potential recovery outweighs the costs involved, including fees paid to debt recovery agencies or legal expenses.

– Likelihood of Recovery: Even if a court judgment is obtained, enforcing it can be challenging. Various enforcement options, such as warrants of execution, attachment of earnings, or third-party debt orders, may be available, but each has its limitations.

The Innovative Approach of Find UK People®

Find UK People® has developed innovative solutions to address common challenges in debtor tracing, such as the “denied at door” scenario. Their service includes providing current photographs of the debtor and their partner, which can be invaluable for enforcement agents.

This approach not only improves the chances of successful enforcement but also ensures compliance with legal requirements.

To Sum up

Tracing debtors in the UK requires a strategic approach, specialised knowledge, and access to extensive data sources. By employing the services of a professional tracing agency like Find UK People®, creditors can significantly increase their chances of locating debtors and recovering owed amounts. Whether you are considering pursuing a debt or evaluating the debtor’s financial situation, having the right information and expert support is crucial to success.

In summary, while debtor tracing can be complex and challenging, the right approach can lead to successful outcomes, ensuring that creditors can recover what is rightfully theirs.

Locate Your Debtors Now! 🚀

Don’t let debtors disappear. With expert debtor tracing, you can track them down and recover what’s owed to you. Get started with Find UK People®—quick, reliable, and no-find no-fee.

Ready to take action? Start Tracing Today!

Tracing Debtors in the UK

Tracing Debtors in the UK